Once upon a time in Kolkata-headquartered innerwear and outerwear clothing manufacturer, Rupa & Company has successfully launched its first shop, in 1968, the Indian hosiery market was normally dominated by unorganized players, barring a couple of strong domestic companies such as Dora, Asli Hira, and Asli Sona. So Rupa & Company decided to go with a unique brand name Chandi means (silver).”

Actually Chandi translates to rupo or rupa in Bengali. The decision of brand name was led by a need to differentiate and yet belong because it was a very competitive market. As per the information gathered Brand Dora dominated, like Monopolistic means No hosiery store would sell anything else but Dora. To penetrate into the market they adapted two new approaches, First was Innovation for example in the early ’70s, Rupa launched elastic strap underwear for men, and second was Discipline and work ethics.

The company’s development until now is unquestionable. Today, Rupa and Co., with a total income of ₹1,222.27 crores for FY19, has a strong presence across India through a versatile distribution channel network of 125,000 retailers, in excess of 1,200 discount sellers and more than 300 sales and marketing experts. Rupa stays a family-possessed venture with promoter’s holding at 73.28% as of December 2019. It deals with an arrangement of around 18 brands and more than 8,000 SKUs (stock-keeping units) across ranges for men, ladies, and kids; at the back end, it has state-of-art production facilities in Bengaluru, Tirupur in Tamil Nadu, Ghaziabad in Uttar Pradesh, and Kolkata in West Bengal.

Rupa had a solid hang on the knitwear business till the late 2000s. To such an extent that it was even named the nation’s biggest maker of weaved underpants for a long time straight till 2010 by Limca Book of Records. Its prosperity drove it to a list on the Calcutta and Jaipur stock trades in 1995-96, trailed by the National Stock Exchange and Bombay Stock Exchange in 2010-11 (where it at present trading at ₹150, as of May 15, 2020).

During that time, Rupa wore the disruptor tag gladly, with new items and accentuation on quality. For instance, from the start, German sewing and coloring machines were utilized for assembling and sophisticated technology-based Swiss machines for completing the items. “Before we propelled Thermocot [Rupa’s warm wear brand], comparative woolen material thermals were accessible in the market. In any case, we initially propelled a Television ad around two decades back on warm wear to make mindfulness about the classification,” refers to K.B. Agarwala for instance of the disturbance, including, “We initially propelled sewed Bermudas [Bumchums] for men in the mid-’90s. Before that, it was for the most part pants with a cotton circle.”

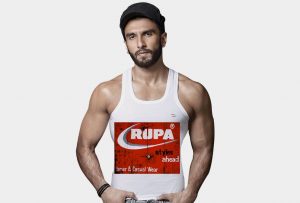

Between the mid-’90s and late 2000s, it propelled fruitful economy-to premium brands, for example, Macroman, Frontline, Air, Softline, Jon, and Bumchums. This set the pace for a forceful publicizing and limited time push upheld by superstar supports. Among the first was Aishwarya Rai Bachchan in 1988-89, even before she became Miss World in 1994. From that point forward, it has manufactured an A-rundown including on-screen characters Saif Ali Khan, Sanjay Dutt, and Hrithik Roshan, in any case, and now Ranveer Singh, Ranbir Kapoor, Sidharth Malhotra, and Anushka Sharma. The finish of the noughties, be that as it may, saw Rupa lose it’s magic and authority status all the while. Industry specialists state that the organized and execution-driven hard-working attitude disposition transformed into an unfair limitation for the Kolkata-headquartered organization.

The organization has developed from solidarity to quality in the course of the most recent two decades, offering a scope of more than 100 items across 15 brands for men, ladies, and kids and more than 5,000 SKUs (Stock Keeping Units) over its current scope of items. With six assembling offices remembering four for West Bengal, and one each in Tirupur and Ludhiana (Punjab), Lux trades its items to Iran, Iraq, Kuwait, Bahrain, Saudi Arabia, Singapore, Canada, Australia, and the United States, among others. In FY19, the organization’s exports bounced to ₹136 crores from ₹105 crores in FY18—this is relied upon to go up to ₹175 crores in FY20. Despite the fact that the mass and economy portions in the men’s innerwear space structure the main part of both Lux and Rupa’s pieces of the overall industry, the previous has figured out how to understand the capability of big-name brand diplomats better, particularly in a value touchy market with a huge rustic base, say specialists. Devangshu Dutta, Chief Executive Officer of retail consultancy Third Eyesight, feels to increase any kind of premium over equivalent items, an organization needs to significantly and reliably put resources into well-planned market and advertising activities. “Organizations that do so can lead the market.”

Lux Cozi introduces India’s first ever scented vest range launched by Varun Dhawan

Lux has put ₹380.56 crores in brand working in the five years finishing FY19, as per information from its yearly report in the last financial; of this, ₹90.89 crore was on promoting alone. This is a basic since India’s innerwear sector pegged at ₹27,931 crores a year ago and expected to develop at a CAGR of 10 percent to an expected ₹74,258 crore by 2027—has changed altogether since the mid-2000s. Driving that change is present pioneer Bengaluru-based Page Industries, the sole licensee for clothing producer Jockey in India. “Jockey lifted the whole normal cost of the innerwear fragment. There was a major move in the value point. What’s more, the market is prepared to follow through at a greater expense. Page Industries made new guidelines in the market [through] the separation of items. Today organizations can’t pull off selling fundamental items,” says Bisen of Technopak.

In 1994, Sunder Genomal, MD (Managing Director), Page Industries, alongside his two siblings, set up the organization in India for assembling, appropriation, and showcasing of Jockey items. Be that as it may, they have been in the innerwear business since 1959 when Genomal’s dad set up their first processing plant in The Philippines where they were additionally Jockey’s elite licensee. (Page Industries is additionally the elite licensee of swimwear brand Speedo in India.) Today Jockey has a nearness in more than 55,000 outlets across India. In FY19, the organization through its approved franchisees opened 161 exclusive brand outlets (EBOs) including nine Jockey Woman outlets taking the all outnumber of EBOs to 620. At present, its introduced limit is spread over 2.40 million sq. ft. at 14 areas in Karnataka and one in Tamil Nadu.

Kolkata-based knitwear-producer Rupa and Company are hoping to fortify its retail nearness by setting up 150 exclusive brand outlets (EBOs) and making its respected products accessible in 300 large-format stores in the following two years. It is additionally hoping to increase deals through the online e-commerce platform like Flipkart, Amazon, Jabong, Myntra and Snapdeal, etc, including its own site.

The organization at present has five EBOs – Rupa Comfort Store – essentially in the eastern area. While these stores are as of now organization claimed and the organization worked, it is hoping to receive the franchisee model for setting up its stores, pushing ahead.

“The eastern area at present records for 35-40 percent of our all-out deals. We have a sensible nearness in western, southern, and central markets. We are hoping to expand our entrance in these business sectors by setting up EBOs,” Dinesh Lodha, CEO, Rupa, and Co, told in a media interview.

Rupa presented the Macroman M Series, an excellent design line of innerwear and sportswear for men. Hrithik Roshan was roped in as brand endorser; the brand Euro was likewise added to the top-notch classification. As another indication of remaining with the occasions, the Agarwals began Oban Fashions Private Limited, an auxiliary of Rupa and Co. that works the Indian business of worldwide brands under an authorizing model. In FY17, Oban Fashions gained selective licenses for brands FCUK from French Connection Limited, and Fruit of the Loom from New York-based Fruit of the Loom Inc. (an entirely claimed auxiliary of Berkshire Hathaway) to create, assembling, market, and sell innerwear and related items in India. Rai’s grandson Siddhant Agarwal at present cares for this business.

“In an offer to improve the offer in the developing premium menswear portion, the organization attempted different authorizing of universal brands,” says ICICI Direct’s examination report on Rupa from August 2019. But since of serious rivalry from brands, for example, Van Heusen (from Aditya Birla Fashion), and Calvin Klein (Arvind Fashions is the Indian licensee), the administration has not had the option to scale up its business as per desires, the report says. “Higher impetuses offered by contenders have contrarily affected the offtake from sellers.” If the organization’s pace appears to be frantic, the explanation is as K.B. Agarwala puts it: “There is a ton of rivalry in the market. Difficult work is extremely vital to remain ahead.”

Rupa has forceful designs for current retail exchange that incorporates EBOs, expanding nearness across web-based business stages, and huge configuration stores, for example, DMart, multi-brand retail chain V-Mart Retail, and Metro Cash and Carry. It as of now has four organizations possessed EBOs in the eastern area. It intends to open around 100 restrictive brand outlets the nation over in the following two years, through the more monetarily reasonable franchise model. “Before, we opened huge size EBOs (500-600 sq. ft.) however we understood that financially it’s anything but a practical model in light of the fact that the normal ticket size (₹150-₹200) of the item sold is too little to even consider supporting the upkeep of a huge outlet. Presently we are taking a gander at a store size of 250-300 sq. ft.,” says Vikash Agarwal, 43, president, Rupa, and Co.

Another positive sign is the expanded potential in the premium-to mid-premium sections. For Rupa, a solid player in the mid-to economy classification, the discount has been about 70%-80% of its complete business. Be that as it may, the margin for the economy fragment in innerwear is about 11%-12%, while the superior class orders about 18%-20%. “Presently with the move towards the superior class we can expect better overall revenues,” says Vikash.

Rupa likewise needs to improve its commitment from overseas markets, which is as of now a little level of its turnover not at all like contender Lux Industries. “We mean to make it about 10% of the turnover in the following three to four years. The reaction is acceptable and ideally, we will accomplish the objective. Presently, we have started exporting to Myanmar, Algeria, Middle East, Nigeria, Ghana, Vietnam, and Indonesia,” includes Ramesh Agarwal, 50, Full-time Director and Chief Financial Officer, Rupa, and Co.

Leading market players to now challengers, Rupa—and Lux—appear to have slipped into their new jobs with certainty. Since, says Bisen, “the last 15-20 years have seen enough of hardened expectations to learn and adapt for these brands to comprehend what works in the market now and how they should be careful and consistently improve to take advantage of new lucky breaks.” More significantly for Prahlad Rai Agarwala, what Rupa has on its side is “the way of life of family discipline”. Nobody knows what’ll occur straightaway, he says, yet “that [the ethos] is as yet going solid is as yet flawless to maintain the business”.

Having finished 50 years in business, one of India’s Leading knitwear company in India, Rupa and Company have set out on a high development way with an expect to twofold its income in three to four years and become the market leader through gainful development.

“In the course of the most recent 50 years, Rupa has effectively become an easily recognized name. As of now, we see a colossal development potential in womenswear, kidswear, and athleisure,”

“Likewise, we are focussing on internal wear and external wear also. Increasingly premium items will be propelled later on and this portion will drive the following period of development,

Innerwear maker Rupa and Company Ltd. is concentrating on extending geological reach with an end goal to be available wherever when request—in any event, for the innerwear is fading.